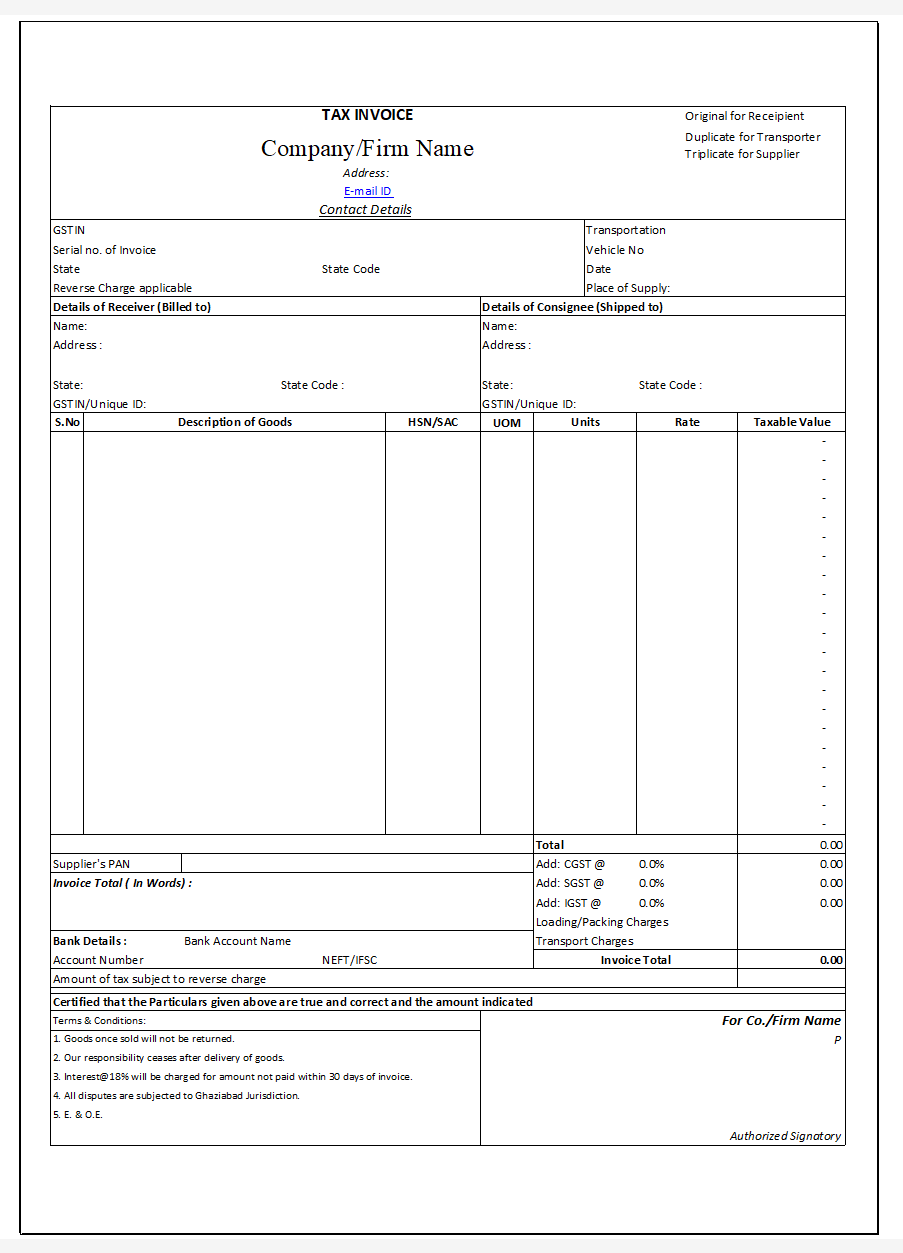

Tax Invoice Template

GST-compliant tax invoice template for Indian businesses. Includes all mandatory fields required for proper billing and tax compliance.

Why Use This Tax Invoice Template?

GST Compliance

Meets all GST requirements with mandatory fields like GSTIN, HSN/SAC codes, tax calculations, and proper format as per Indian tax regulations.

Professional Image

Creates a professional impression with clients and vendors, showing that your business follows proper accounting and documentation practices.

Input Tax Credit

Enables your customers to claim input tax credit properly, making your invoices more valuable and preferred by business clients.

Legal Protection

Protects your business from tax penalties and legal issues by ensuring all invoices meet statutory requirements and contain proper documentation.

Record Keeping

Maintains organized business records with consistent invoice format, making accounting, auditing, and tax filing processes much easier.

Faster Payments

Clear and professional invoices with all necessary details help customers process payments faster and reduce payment delays.

Understanding the Tax Invoice Template

1. Header Information

-

Invoice Title: "TAX INVOICE" clearly displayed at the top

-

Purpose: Original for Recipient, Duplicate for Transporter, Triplicate for Supplier

-

Company Details: Business name, address, email, and contact information

2. Business Information

-

GSTIN: Goods and Services Tax Identification Number

-

Serial Number: Invoice serial number for tracking

-

Date & State Code: Invoice date and state code of business location

-

Reverse Charge: Indicates if reverse charge mechanism applies

3. Transportation Details

-

Transportation: Vehicle number for goods transportation

-

Date: Date of goods dispatch or transportation

-

Place of Supply: Location where goods are delivered

4. Customer Information

-

Receiver Details: Customer name and billing address (Billed to)

-

Consignee Details: Delivery address if different (Shipped to)

-

State Information: Customer's state and state code

-

GSTIN/Unique ID: Customer's GSTIN or unique identification number

5. Product/Service Details

-

Serial Numbers: Item-wise serial numbers for easy tracking

-

Description: Detailed description of goods or services provided

-

HSN/SAC: Harmonized System of Nomenclature or Service Accounting Code

-

UOM: Unit of Measurement (pieces, kg, liters, etc.)

-

Quantity & Rate: Number of units and rate per unit

-

Taxable Value: Value before adding taxes

6. Tax Calculations

-

CGST: Central Goods and Services Tax calculation

-

SGST: State Goods and Services Tax calculation

-

IGST: Integrated Goods and Services Tax (for inter-state transactions)

-

Loading/Packing: Additional charges for loading and packing

-

Transport Charges: Freight and transportation costs

-

Invoice Total: Final amount including all taxes and charges

7. Payment & Legal Information

-

Supplier's PAN: Permanent Account Number of the supplier

-

Amount in Words: Invoice total written in words

-

Bank Details: Bank account information for payments

-

NEFT/IFSC: Bank codes for electronic fund transfers

-

Terms & Conditions: Payment terms, return policy, and legal conditions

-

Certification: Statement certifying the accuracy of invoice details

-

Authorized Signatory: Space for authorized person's signature

Pro Tip

Always keep the HSN/SAC codes updated as per the latest GST classification. Use accounting software to automatically calculate taxes and generate invoices to reduce errors and save time. Also, ensure you maintain sequential invoice numbering throughout the financial year for proper compliance.

How to Use This Template

Download and Customize

Download the template and fill in your business details including company name, address, GSTIN, PAN, and bank account information. Add your logo and customize the design to match your brand.

Fill Customer Information

Enter complete customer details including name, address, GSTIN (if applicable), and state code. Ensure shipping address is filled if different from billing address.

Add Product/Service Details

List all items with proper description, HSN/SAC codes, quantity, rate, and calculate taxable value. Use correct HSN codes as per GST classification for your products or services.

Calculate Taxes Correctly

Apply appropriate tax rates (CGST, SGST for intra-state or IGST for inter-state). Double-check calculations and ensure the total amount matches the sum of taxable value and all applicable taxes.

Review and Send

Review all details carefully, ensure sequential invoice numbering, and verify that all mandatory fields are filled. Save a copy for your records before sending to the customer.

Best Practices for Tax Invoicing

| Do | Don't |

|---|---|

| Use sequential invoice numbering throughout the financial year | Skip invoice numbers or use duplicate numbers |

| Verify customer GSTIN before issuing invoice | Issue invoices with incorrect or invalid GSTIN |

| Use correct HSN/SAC codes as per GST classification | Use generic or incorrect classification codes |

| Calculate taxes accurately and double-check totals | Make calculation errors or wrong tax applications |

| Keep digital and physical copies of all invoices | Delete or lose invoice records |

| Issue invoices immediately after supply of goods/services | Delay invoice generation beyond statutory timeline |

| Include all mandatory fields and information | Skip required fields or provide incomplete information |

| Update invoice format as per latest GST amendments | Use outdated formats that don't meet current requirements |

Download Your Free Tax Invoice Template

Get GST-compliant tax invoice template with all mandatory fields for Indian businesses.

100% FREE - No registration required!

Available in DOC format for easy customization

Download TemplateEnsure GST Compliance for Your Business

Proper tax invoicing is not just a legal requirement but also essential for maintaining professional business relationships. This template ensures you meet all GST compliance requirements while presenting a professional image to your customers.

Use this template to create consistent, compliant invoices that help your business maintain proper records, enable customer input tax credit claims, and avoid potential penalties from tax authorities.

Frequently Asked Questions

What is a Tax Invoice and why is it important?

A Tax Invoice is a legal document issued by a GST-registered business when supplying goods or services. It contains all mandatory details required under GST law, including GSTIN, HSN/SAC codes, tax calculations, and customer information. It's important because it enables customers to claim input tax credit, serves as proof of transaction, and ensures compliance with tax regulations.

When should I issue a Tax Invoice?

You must issue a Tax Invoice at the time of supply of goods or services, or before the supply in case of advance payments. For goods, the invoice should be issued before or at the time of delivery. For services, it should be issued before or at the time of providing the service. The invoice must be issued within 30 days of supply.

What happens if I don't use proper Tax Invoice format?

Using improper invoice format can lead to various issues including rejection of input tax credit by your customers, penalties from tax authorities, difficulties during tax audits, and potential legal complications. The GST department can impose penalties up to Rs. 25,000 for not maintaining proper invoices and records.

Can I customize this template for my business?

Yes, you can customize the template by adding your business logo, changing colors and fonts, and adjusting the layout to match your brand. However, ensure that all mandatory fields required under GST law remain present and clearly visible. You can add additional fields specific to your business needs but cannot remove the required GST fields.

How should I maintain invoice records?

Maintain both digital and physical copies of all invoices in chronological order. Store them securely for at least 6 years as required by GST law. Use sequential numbering throughout the financial year, backup digital copies regularly, and ensure easy retrieval for tax audits or compliance checks. Consider using accounting software for better organization and automatic compliance.

What is the difference between CGST, SGST, and IGST?

CGST (Central GST) and SGST (State GST) are applied on intra-state transactions (within the same state), where both central and state governments collect their respective shares. IGST (Integrated GST) is applied on inter-state transactions (between different states), where only the central government collects the tax and later shares it with the destination state. The total tax rate remains the same, only the collection mechanism differs.